Build an emergency fund that really protects you

Emergencies strike without asking permission: job loss, car repairs, or an unexpected medical bill. Je am here to walk vous through building a solid emergency fund—from a starter $500 cushion to a full six months of expenses—so vous can face shocks with calm instead of panic. This guide covers how to begin, where to keep your money, how to grow the fund, and how to handle irregular expenses that often derail plans.

Why create an emergency fund and what it protects

The role of a starter emergency fund

A starter emergency fund is your first line of defense. I recommend beginning with $500 because it's achievable and immediately reduces vulnerability. That small pool covers minor but disruptive costs like a broken phone screen or an urgent vet visit, preventing you from relying on high-interest credit.

The financial safety net function

An emergency fund is a financial safety net that prevents debt accumulation and preserves long-term goals. When vous have cash on hand, vous avoid using credit cards or payday loans that can compound financial stress. Think of this fund as liquidity insurance: it keeps your broader savings and investments intact.

How to save your first $500 and build momentum

Practical steps to reach $500 quickly

Start with realistic micro-goals. Je suggest:

- Automating a small transfer (e.g., $25 weekly).

- Selling one item you no longer use.

- Redirecting a single recurring subscription for a month or two. These tactics create quick wins and build habit without pain.

Creating a consistent savings habit

Once you hit $500, momentum matters. Je advise setting a recurring contribution timed with paydays. Even modest amounts—$50 or $100 per paycheck—compound into meaningful buffers over months. Celebrate milestones; it keeps motivation high.

Growing to three and six months of expenses

Calculating your monthly expenses

To aim for 3–6 months, vous must know your baseline. Tally fixed costs (rent, loans), essentials (groceries, utilities), and minimum debt payments. Multiply by three or six. This realistic target helps vous avoid under-saving or overshooting based on wishful thinking.

Phased approach: three months first, six months later

I recommend a phased plan: reach three months of essentials first, then push toward six months if your job or income fluctuates. A three-month fund handles short-term shocks; six months provides greater stability for job transitions or extended medical needs.

Best accounts for your emergency savings

Choosing the right savings account

Accessibility and safety are key. Look for:

- High-yield savings accounts for better returns.

- No-penalty access—you must withdraw quickly when necessary.

- FDIC or NCUA insurance for security. Avoid tying emergency money to investments with market risk.

Where not to put your emergency fund

Keep emergency money out of volatile assets like individual stocks or long-term bonds. Je suggest keeping the fund liquid. Certificates of deposit can work only if you have a ladder strategy that preserves access.

Managing irregular expenses without derailing the fund

Planning for uneven bills and seasonality

Irregular expenses—insurance premiums, car registrations, holiday costs—can surprise vous. Create a separate sinking fund for predictable but irregular bills. Allocate a monthly amount so, when the bill arrives, the emergency fund remains untouched.

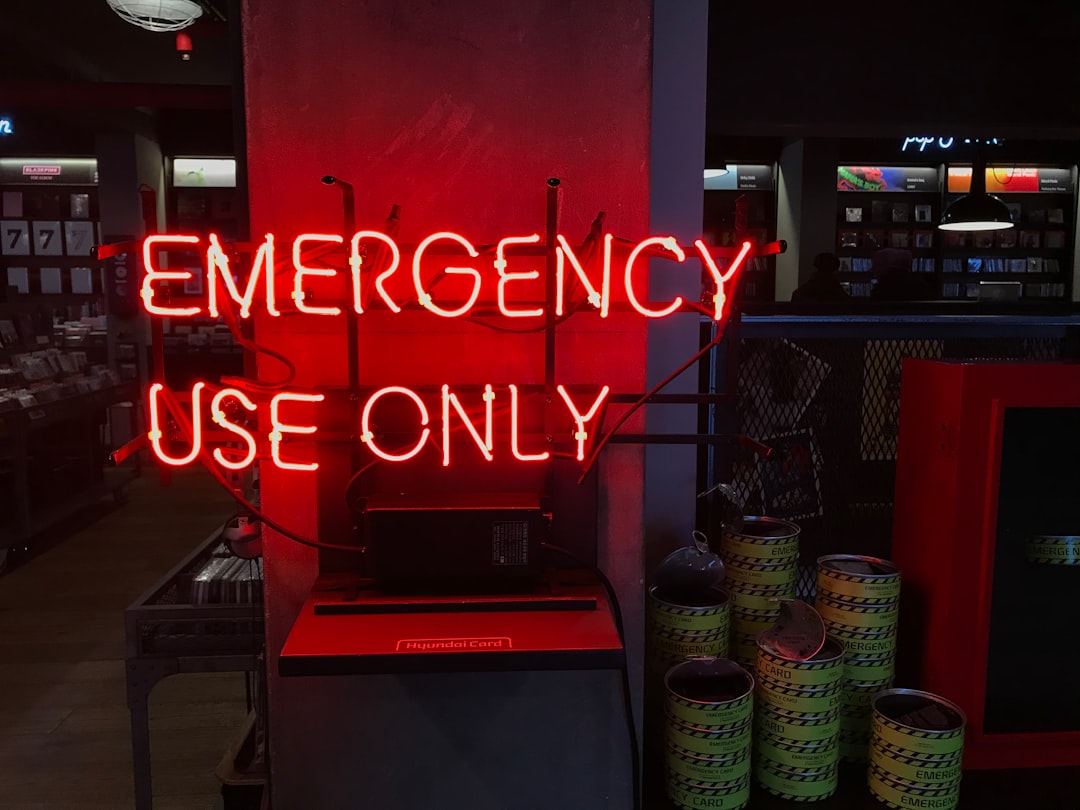

When to tap the emergency fund versus other sources

Use the emergency fund for true emergencies: sudden loss of income, urgent repairs, medical crises. For planned irregular expenses, prefer sinking funds or short-term savings envelopes. This preserves your financial safety net for real shocks.

Automation, monitoring, and replenishment tactics

Automate for consistency

Automate transfers to your emergency fund. Automation reduces decision fatigue and ensures progress even during busy months. Je arrange automatic increases when vous get raises—small boosts that add up.

Rebuild after withdrawals

If vous need to use the fund, prioritize a replenishment plan. Resume automated contributions and, if possible, add a temporary extra amount until vous restore your target. Treat rebuilding as the continuation of your financial resilience journey.

- Start with a realistic $500 starter fund to break the cycle of reliance on debt.

- Calculate monthly essentials to set accurate 3- and 6-month targets.

- Use high-yield, liquid accounts insured by FDIC/NCUA.

- Create sinking funds for irregular but predictable expenses.

- Automate contributions and plan to rebuild if you must withdraw.

Secure Your Emergency Fund: Next Steps to Take Today

I hope vous feel motivated. Je encourage vous to take one concrete step now: set up an automated transfer—even $10—so momentum begins. Track progress monthly, protect the fund in a liquid, insured account, and separate irregular expenses from true emergencies. With these measures, votre emergency fund becomes not just money in an account, but peace of mind you can count on.

When travel or family trips factor into your budget, account for potential cancellation fees, emergency repatriation, or last-minute changes; for practical examples of package pricing and cancellation terms that help estimate those travel-related risks, see clarionworld.co.uk.